Fourth quarter and full year 2018 results

Amsterdam, the Netherlands, 6 February 2019 7:30 AM CET

Throughout this press release we make reference to continuing operations (TomTom excluding Telematics), discontinued operations (Telematics) and total operations (continuing & discontinued).

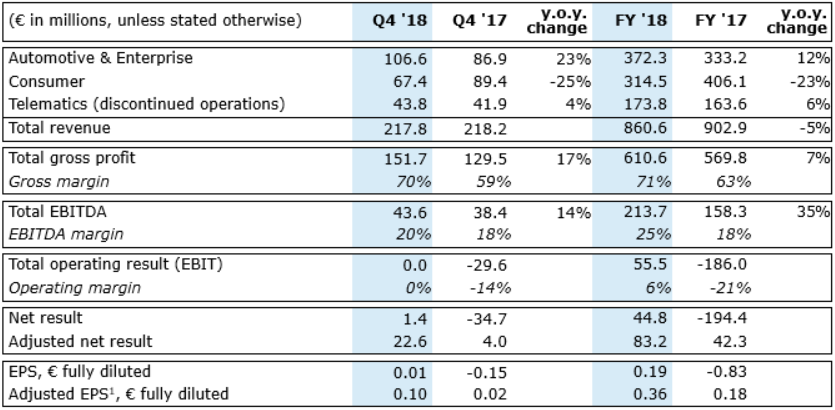

Financial summary fourth quarter 2018

• Total revenue of €218m (Q4 '17: €218m); continuing operations €174m (Q4 '17: €176m)

• Gross margin of 70% (Q4 '17: 59%); continuing operations 67% (Q4 '17: 55%)

• Total EBITDA of €44m (Q4 '17: €38m); continuing operations €28m (Q4 '17: €19m)

Financial summary full year 2018

• Total revenue of €861m (FY '17: €903m); continuing operations €687m (FY '17: €739m)

• Gross margin of 71% (FY '17: 63%); continuing operations 69% (FY '17: 60%)

• Total EBITDA of €214m (FY '17: €158m); continuing operations €142m (FY '17: €87m)

• Net cash position of €252m (FY '17: €121m)

Operational summary

• TomTom sells Telematics business to Bridgestone for a purchase price of €910 million

• Announced €750 million capital repayment

• Collaboration with DENSO to develop an end-to-end autonomous driving system

• Strong Automotive operational revenue growth

• Automotive order intake exceeded €250 million

• Extended Microsoft partnership; now also powering Bing Maps

Key figures (total operations)

TOMTOM'S CHIEF EXECUTIVE OFFICER, HAROLD GODDIJN

“We closed 2018 with a strong fourth quarter, especially in Automotive, and solid cash generation. After the announced divestment of our Telematics business we are now a more focused company.The recent extension of the partnership with Microsoft is another proof of the competitiveness of our product portfolio.

To keep the positive momentum, we will accelerate our investments in strategic areas while generating cash. Those areas are: further improvements in the efficiency of our map-making system, class-leading products and services for the automotive market, including maps for automated driving and developer products (Maps APIs).

We are excited with the progress we have made and the opportunities that are ahead of us.”

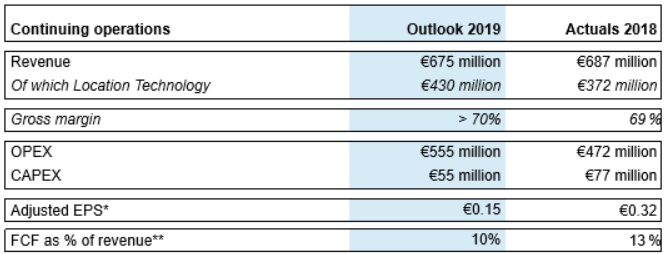

OUTLOOK 2019

The outlook for 2019 is based on TomTom's continuing operations.

In 2019 Location Technology (Automotive and Enterprise) revenue is expected to grow by ~15% year on year. We have decided to accelerate our OPEX and CAPEX spend by ~10% year on year to further improve our competitive position in a constantly changing market and to keep current positive momentum going.

Although the adjusted EPS will decline (~€0.10 of the decline is explained by our Consumer business), we will continue to generate free cash flow around 10% of revenue.

* The adjusted EPS1 is now adjusted as well for acquisition related amortization on a post-tax basis.

** Free cash flow (FCF) is defined as cash flow before financing activities. 2018 FCF of continuing operations was €90 million.

View the full TomTom reports fourth quarter and full quarter 2018 results release on our quarterly results website.